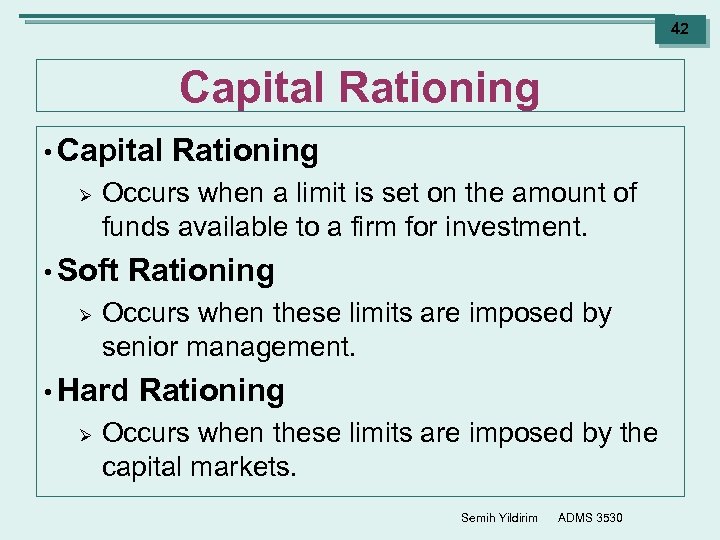

😱 Explain capital rationing. Capital Rationing (Meaning, Example). 20221026

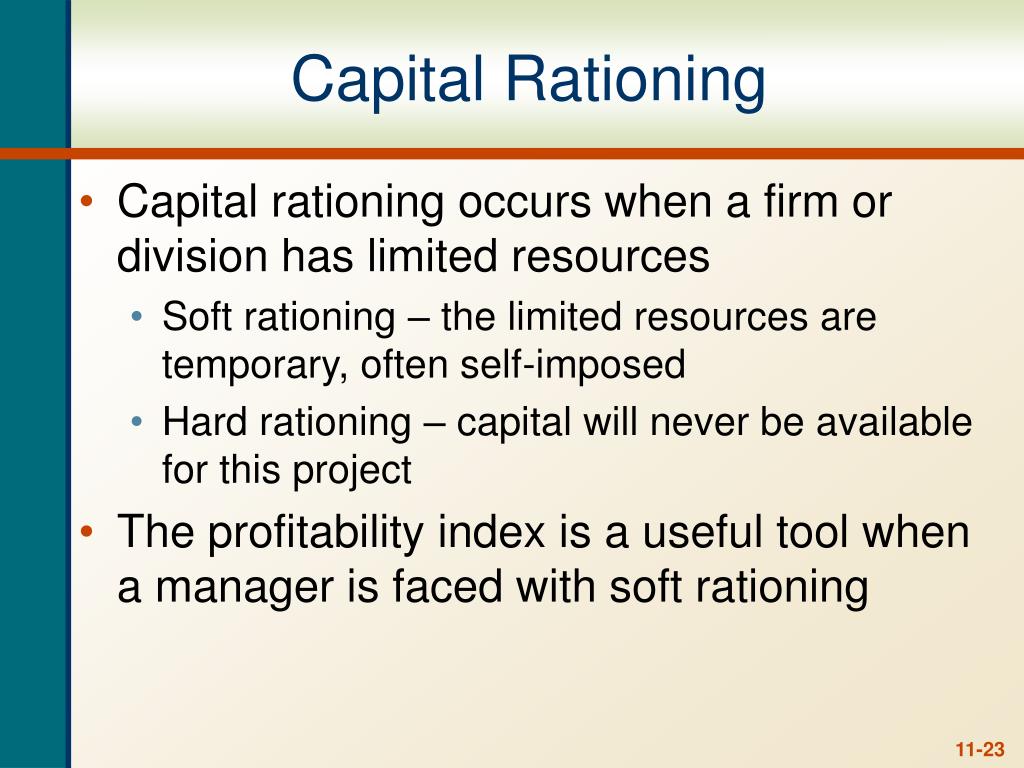

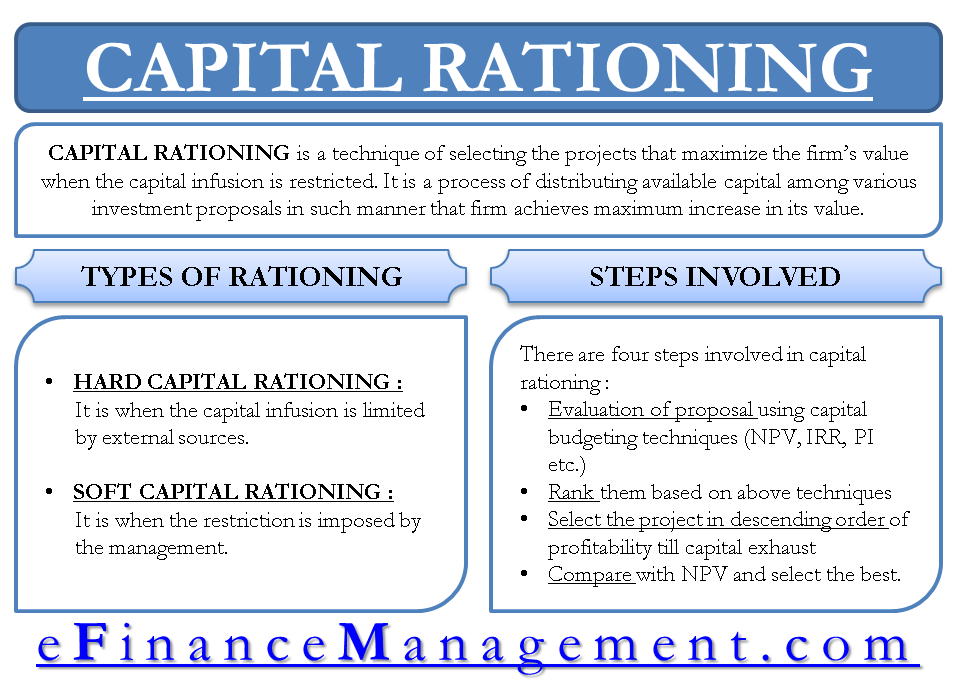

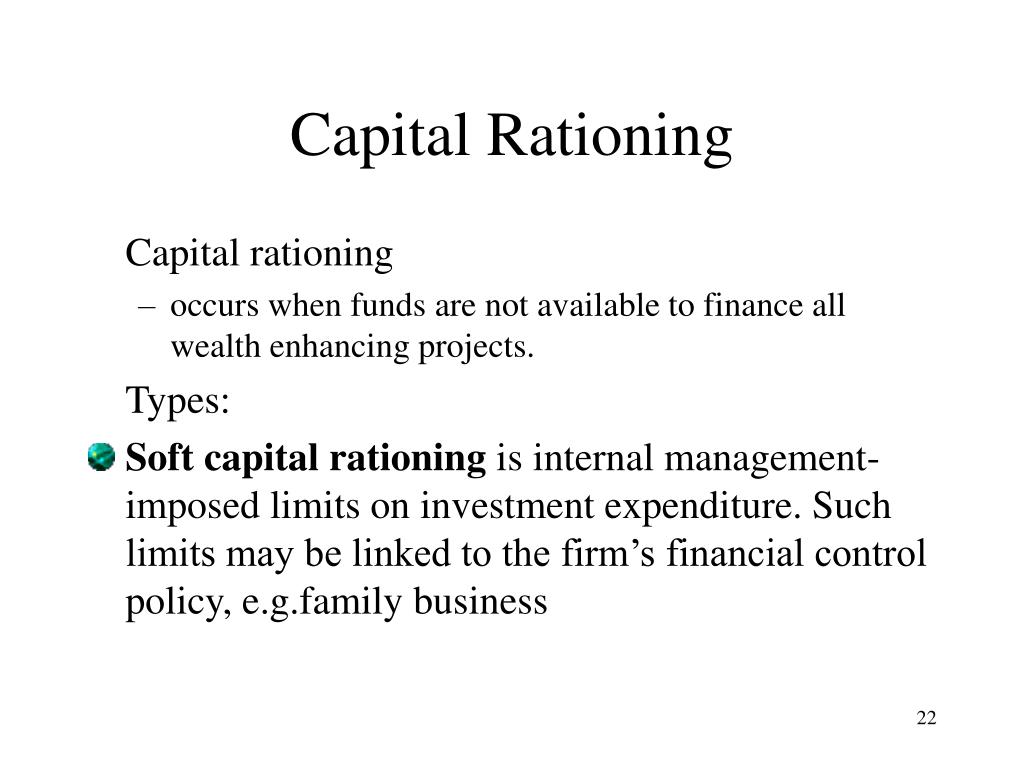

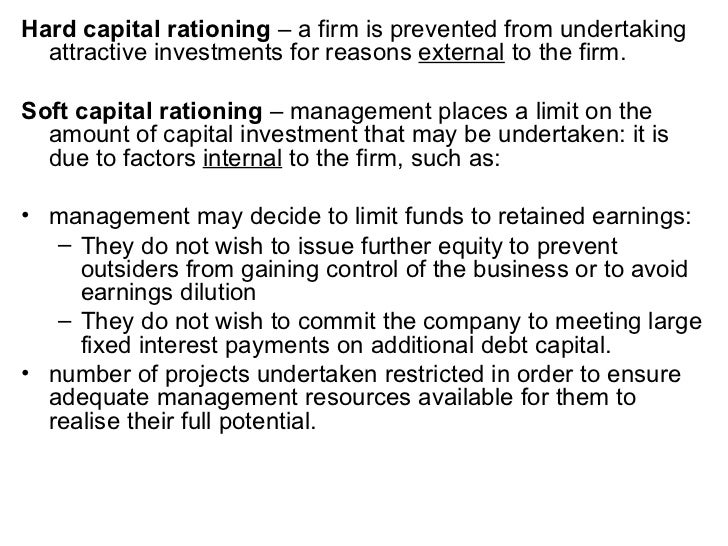

Hard rationing occurs when there is no way to raise more capital. The capital budget cannot be increased in any way. Soft rationing occurs when departments within a company are able to increase their allocated capital budget if they can justify to company management that the additional resources will create shareholder value.

PPT Project Analysis and Evaluation PowerPoint Presentation, free download ID4686722

"Soft" capital rationing. Constraints on spending that under certain circumstances can be violated or even viewed as constituting targets rather than absolute limits. Most Popular Terms:

Capital Rationing Its Assumptions, Advantages and Disadvantages

Soft capital rationing is the situation in which company decides to restrict itself from making a new investment. The company actually has enough capital to invest in more projects but they decide to make the investment on a highly profitable project. There are many reasons behind the soft capital rationing.

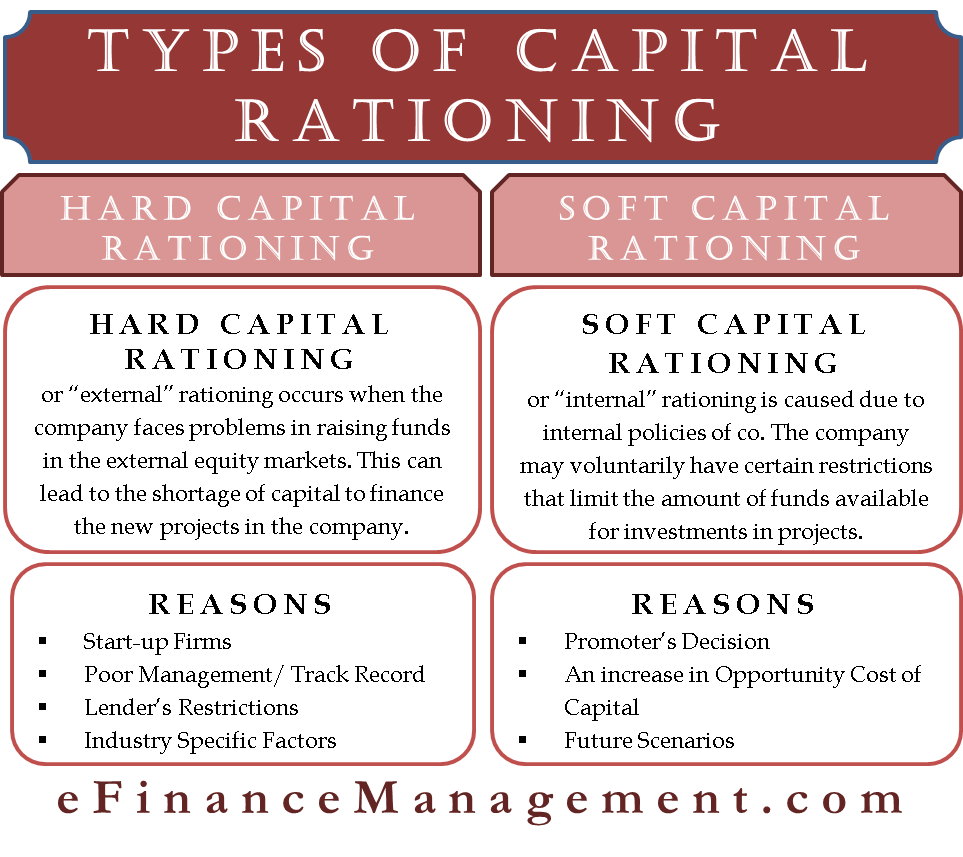

Types of Capital Rationing Hard and Soft

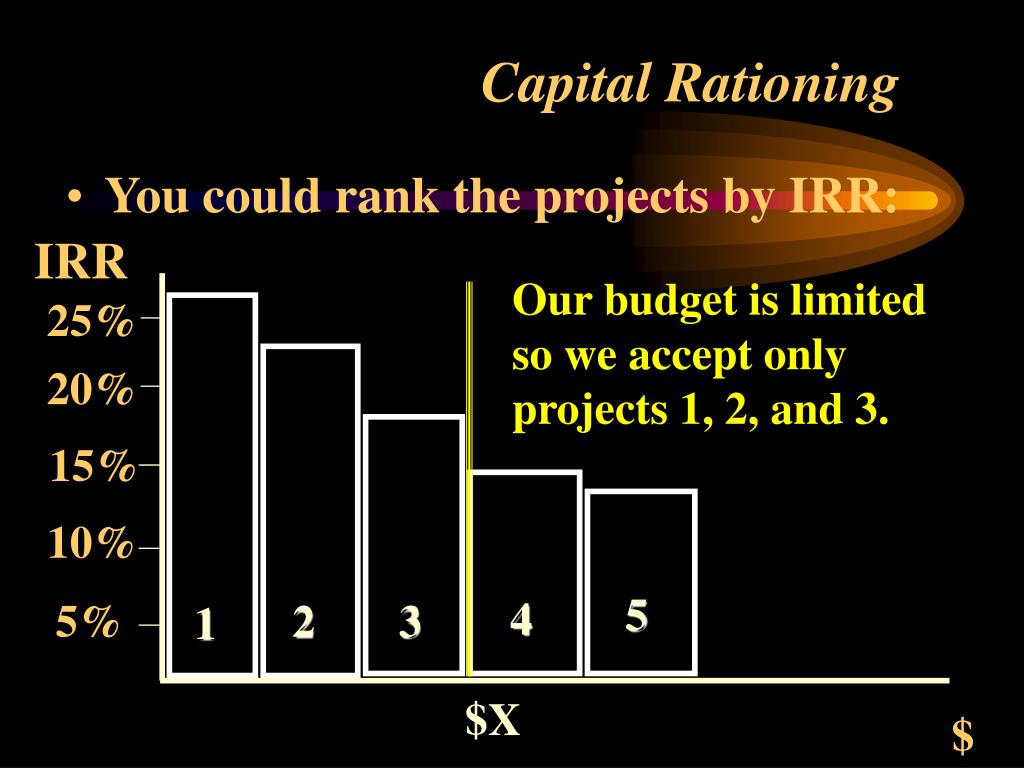

While hard rationing can be challenging for a business, it's sometimes unavoidable. Yet, soft rationing can be an excellent tool for financial management and strategy in a well-functioning market. Capital Rationing Process. In the capital rationing process, the first step is typically assessing whether there is a need to ration capital at all.

Capital Rationing Soft, hard, single and multi period, Management Accounting Lecture Sabaq.pk

In contrast, soft capital rationing refers to a situation where a company has freely chosen to impose some restrictions on its capital expenditures, even though it may have the ability to make much higher capital investments than it chooses to. The company may choose from any of a number of methods for imposing investment restrictions on itself.

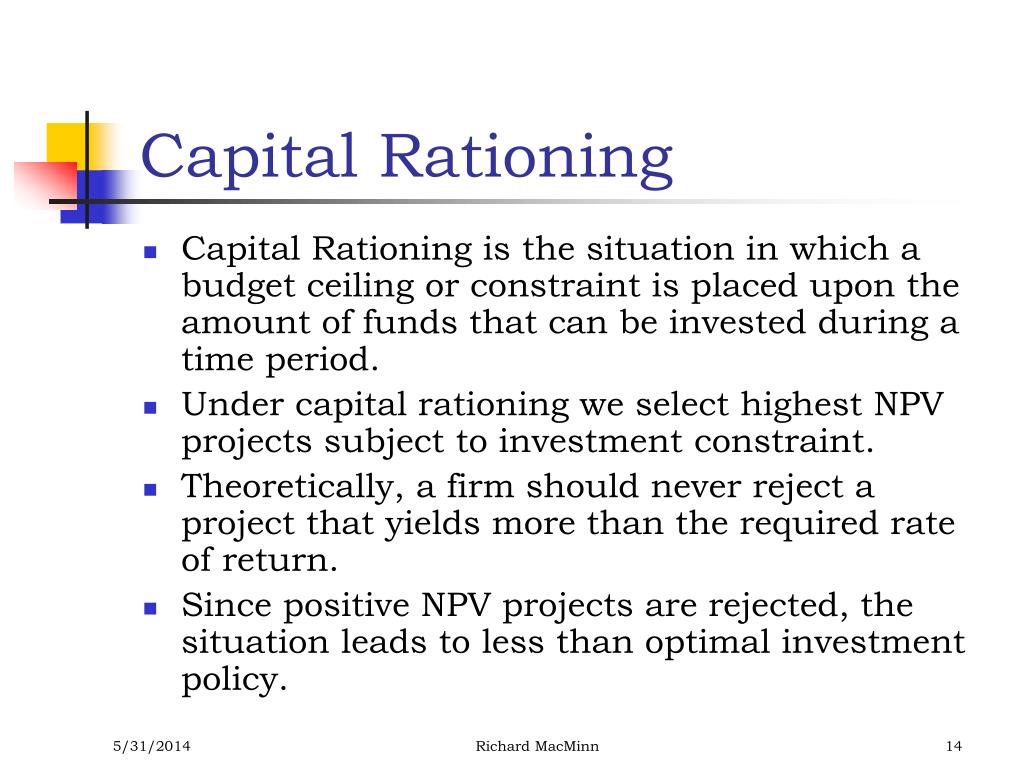

Rationnement du capital Anne Marie

Capital rationing can be hard (external) or soft (internal), driven by factors like difficulty raising funds or internal policies. While capital rationing offers benefits like efficient resource use, it may favor short-term profits over long-term growth and requires careful consideration of return rates. Understanding Capital Rationing

PPT Lecture 3Capital investment appraisal 2 Inflation, Taxation and capital rationing

Discuss the reasons why hard and soft capital rationing occur. (5 marks) The requirement provides a good illustration of the importance of ensuring that the question is being answered. It does not ask for an explanation of what hard and soft capital rationing are, but instead for the reasons why the different types of capital rationing occur.

Capital Rationing A Complete Guide on Capital Rationing with Types

Soft capital rationing: A company may impose its own rationing on capital. This is contrary to the rational view of shareholder wealth maximisation. Reasons for hard or soft capital rationing. Single and multi-period capital rationing. Single-period capital rationing: Shortage of funds for this period only.

Types of Capital Rationing Hard and Soft

Soft rationing is when the practice of limiting the usage of capital funds for diverse projects by constraints set by management. Capital rationing is caused due any limitations imposed by the management or not having enough people or knowledge to complete all the projects.

Capital budgeting

Soft rationing is when capital is restricted based on internal policies and limitations. What is Capital Rationing? Capital rationing is the deliberate restriction of capital.

Capital Rationing, Managing, Types, and Impact

2. Soft Capital Rationing - In contrast, soft capital rationing arises from a company's self-imposed restrictions on capital expenditures.This type of rationing is driven by internal policies and considerations. For example, a financially conservative company may set a high hurdle rate, requiring a projected return on capital that surpasses a predetermined threshold before pursuing a project.

Capital Rationing AwesomeFinTech Blog

Soft capital rationing, also known as internal rationing, is based on the internal policies of the company. A fiscally conservative company, for example, may require a particularly high.

PPT Chapter 10 Cash Flows and Other Topics in Capital Budgeting PowerPoint Presentation ID

Rationing is the practice of controlling the distribution of a good or service in order to cope with scarcity. Rationing is a mandate of the government, at the local or federal level. It can be.

PPT Capital Budgeting PowerPoint Presentation, free download ID503832

Reasons for Soft Capital Rationing Promoters' Decision An increase in Opportunity Cost of Capital Future Scenarios Single Period and Multi-Period Capital Rationing Conclusion On the other hand, soft capital rationing or "internal" rationing is caused due to the internal policies of the company.

1 Chapter 7 NPV and Other Investment Criteria

Soft capital rationing might also arise because managers wish to finance new investment from retained earnings, for example, as part of a policy of controlled organisational growth, rather than a sudden increase in size which might result from undertaking all investments with a positive net present value.

:max_bytes(150000):strip_icc()/CapitalRationing-b258e8b984b94ab4b3906e65c4b4d79c.jpg)

What Is Capital Rationing? Uses, Types, and Examples

Reasons for Soft Capital Rationing . Limited management skills in new area. Want to limit exposure and focus on profitability of small number of projects. The costs of raising the finance relatively high. No wish to lose control or reduce EPS by issuing shares. Wish to maintain s high interest cover ratio